Shirtsleeves to shirtsleeves in three generations – why we should care.

9th May, 2019The accepted experience of family businesses is that only 20 percent reach to the third generation and only 13 percent survive beyond third generation. Despite these odds, family businesses are tremendously successful, they drive the economy. Family businesses generate 64 percent of US Gross Domestic Product (GDP), 60 percent of the workforce, and create 78 percent of new jobs.

Unlike a public company, family owned businesses have additional hurdles to longevity, namely family members. Governance is often at the whim of the owner and not structured for transparency, clarity or objectivity. Patriarchal succession is still a thing, especially within some cultures. Sibling rivalry, favouritism, incompetence, lack of knowledge, disinterest, nepotism, entitlement and greed are some of the landmines to be navigated by a family business.

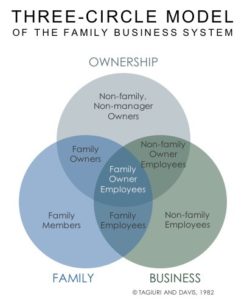

Often there are family members who are not owners, who behave like owners because boundaries are blurred and their roles within the family extend to the business and ownership. To better understand a family business system, The Three Circle Model was created at Harvard Business School, by Renato Tagiuri and John Davis. This framework clarifies, in simple terms, the three interdependent and overlapping groups that comprise the family enterprise: family, business and ownership.

Most families consider only two circles, family and business. Ownership is assumed to be everyone in the family or everyone in the family who is involved in the business, and then the structure runs into problems when ownership transitions to the next generation.

It is important that everyone in the family understands which circle or circles they belong in. Some are exclusive to family, others overlap into business and there are those who intersect all three. Where a son or daughter is speaking to me as an owner, about a decision under consideration, I draw three intersecting circles and ask them to point to where they are in the family business system. Only then does it dawn on them, they don’t own shares, their parents do. This is not their decision.

As a family enterprise grows over time, it can spread to incorporate large cousin families with multiple branches, owners and spouses no longer active in the business, family employees who are not owners, non-family employees with shares, relatives who have been bought out, public owners of shares and minor children owners represented by trustees. All of these people fit within the Three Circle Model, with their perspectives, goals, objectives and rights being understood by it.

This diagram frames the definition of a family company, which is defined by Tagiuri and Davis as:

“A family company is one whose ownership is controlled by a single family and where two or more family members significantly influence the direction and policies of the business, through their management positions, ownership rights, or family roles.”

Each of the seven interest groups identified by the Model has its own perspectives, goals, objectives and dynamics. The views of each group are legitimate and deserve to have a voice and be respected. The different viewpoints must be integrated if the family business system is to function effectively. The long-term success of a family enterprise relies on the mutual support of each of these groups.

Most company owners have blueprints in place for current operations and the management teams to execute plans and strategies, but any plans for handing over the reins are not articulated well, if at all. With no clear exit or transition plan, owners are putting their families in harms way, risking the successful continuation of the family enterprise, jeopardizing family relationships and undermining family wealth.

Many business owners lack any pressing financial reason to start planning for retirement, as most could afford to retire without selling the business or their shares in the business. Without a need for liquidity, it appears many owners fail to plan for it.

Another reason to procrastinate is the lack of a safe place for leadership to have a discussion of “what if” questions, without sending a ripple of fear through the organization and family members. They need a safe venue, with an experienced moderator and advisors to craft a succession plan.

Today, many owners are in their late sixties and seventies. Perhaps they are enjoying what they are doing, or they lack confidence in the next generation. Whatever their reasoning, it is often a triggering event, health or financial, that prompts them, otherwise they persist in trying to retain control of day to day management, refusing to pass the business on. We must motivate business owners to initiate a process, identify Family Enterprise Advisors and plan for succession.